Crypto regulation news this week centers on U.S. market‑structure momentum and the push to define clear jurisdiction. The signal markets care about is whether rules become predictable enough to attract builders and liquidity onshore — while still protecting consumers.

Key Takeaways

- U.S. market-structure legislation is again a central driver for regulation headlines. (Fox Business)

- CFTC Chair Michael Selig said the bill could make the U.S. the “gold standard” for crypto regulation. (Fox Business)

- Regulation affects exchange compliance, banking access, stablecoin rules, and token classification.

- Watch specifics: token taxonomy, custody requirements, and defined regulator boundaries.

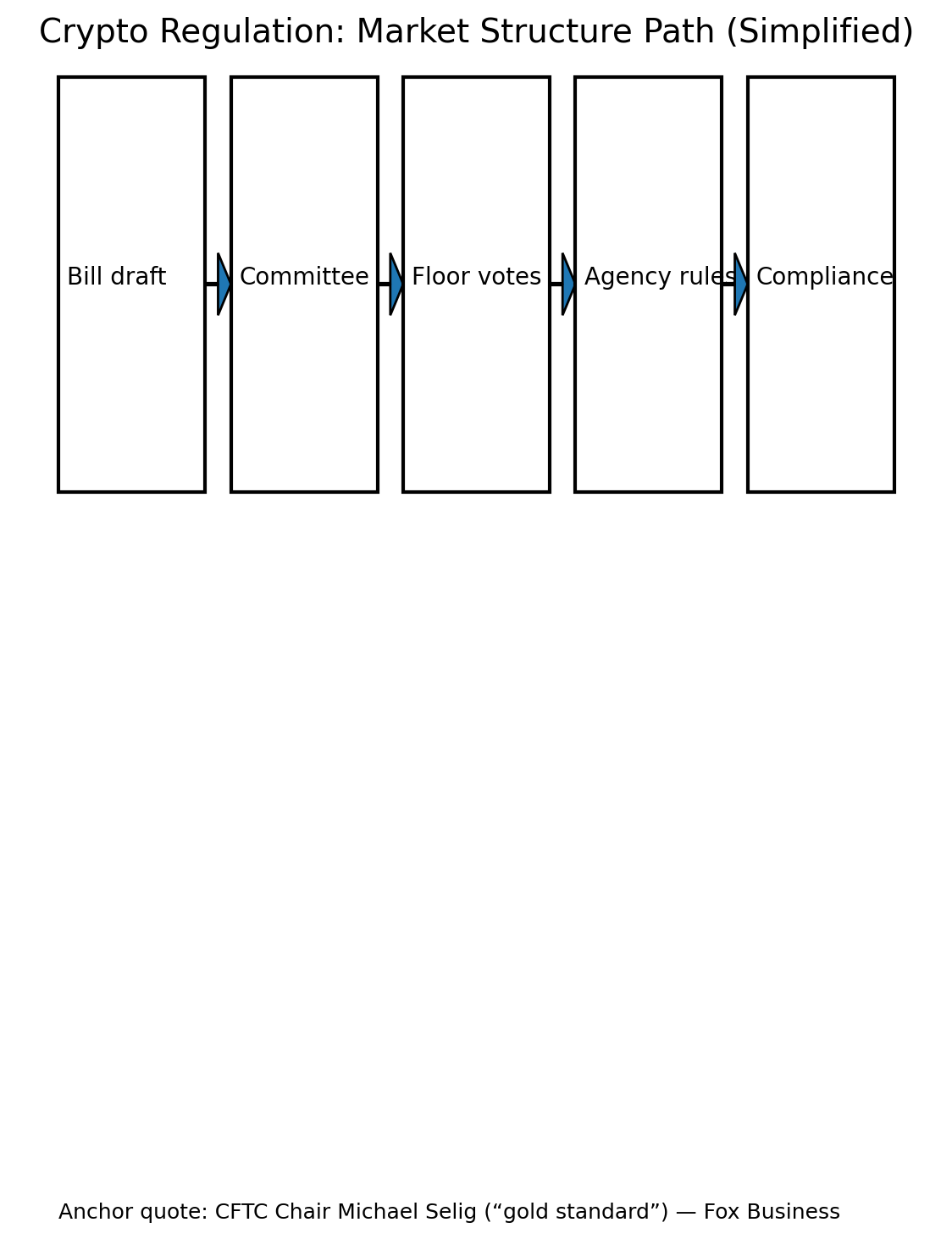

Regulation pathway (original visual) anchored to Michael Selig’s “gold standard” quote (Fox Business).

What’s happening in regulation right now

In early February 2026, a renewed push for market structure rules has moved back into the spotlight. In a Fox Business interview, CFTC Chairman Michael Selig said a bill moving through Congress would make the United States the “gold standard” for crypto regulation and argued that clear rules are long overdue.

That matters because it suggests an effort to deliver what the industry has lacked: predictable jurisdiction and a taxonomy for digital assets that reduces ambiguity for exchanges, issuers, and institutions.

Why it matters for markets (and not just lawyers)

Regulation shapes whether large pools of capital can participate comfortably. Clear rules can reduce the risk premium institutions apply to crypto exposure — but details matter. If compliance burdens are heavy or definitions are overly broad, activity can migrate offshore.

Selig’s emphasis on taxonomy and defined jurisdiction points to the market’s core need: knowing who supervises what, and what compliance path exists.

The areas to watch in the next 30–90 days

1) Market structure: oversight of spot markets and derivatives, and exchange requirements. 2) Stablecoins: issuer rules, reserves, audits, and consumer protections. 3) Banking access: whether crypto firms can reliably obtain and maintain accounts, which affects on‑ramps and custody.

Because the U.S. remains a global liquidity hub, policy shifts here often ripple across jurisdictions and investor expectations.

How to read regulation headlines without overreacting

Most regulation headlines are process, not immediate change. Use regulation news as a probability signal: does the direction look friendlier, more restrictive, or more predictable? Markets respond most to changes in expected future access and compliance clarity, not daily noise.

Sources

Fox Business — CFTC Chair Michael Selig says market structure bill makes U.S. ‘gold standard’ for crypto regulation: https://www.foxbusiness.com/media/cftc-chief-says-pending-crypto-bill-make-us-gold-standard-digital-asset-regulation

February 9, 2026