On crypto-(X) Twitter, people are actively spreading the word about the lawsuit against Pump․Fun and scaring everyone with the collapse of SOL to $5. It sounds dramatic, but let's figure out what's really going on.

Source: Х

Source: Х

What is known about the facts

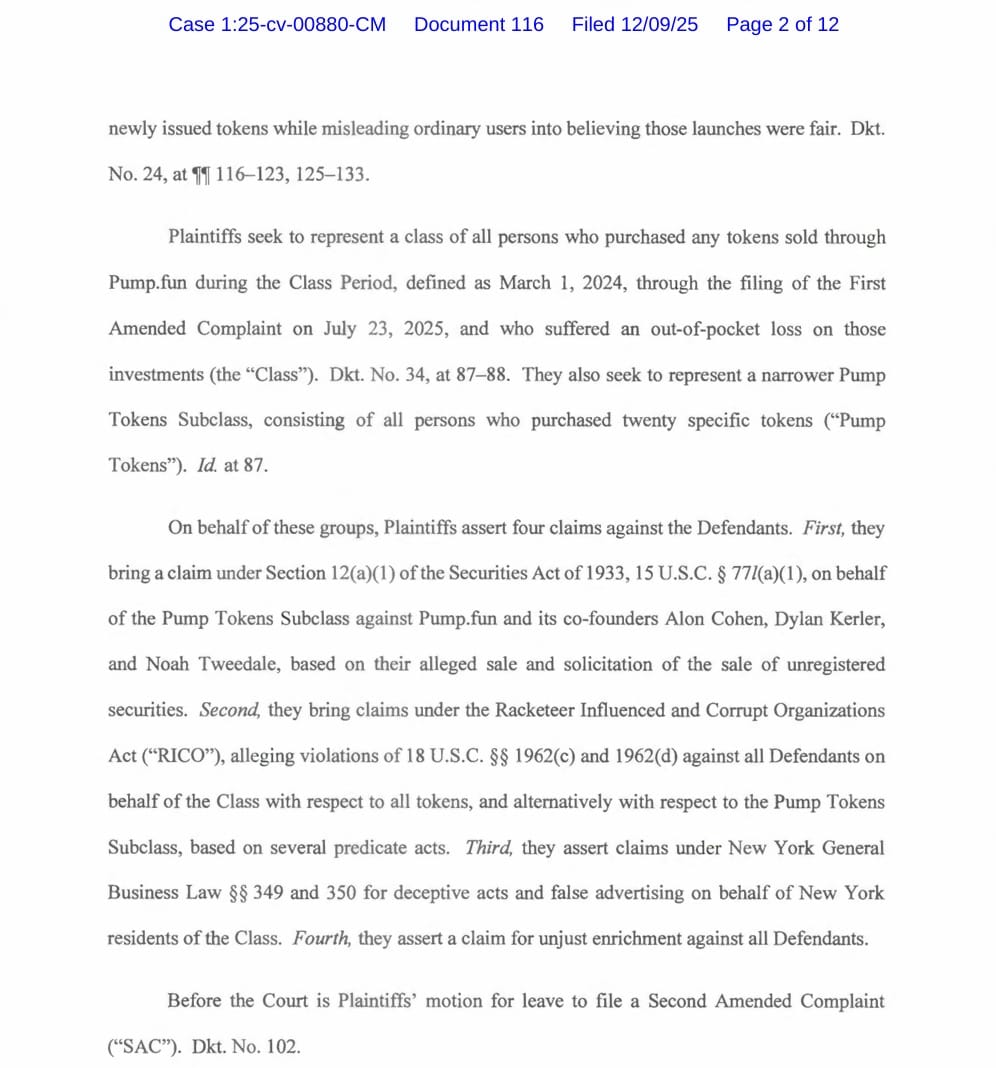

In January 2025, a class action lawsuit was filed against Pump․Fun. It also mentions Solana Labs and Solana Foundation. The plaintiffs claim that they lost money on memecoins and accuse the platform of manipulation.

The key argument of the accusation is that the Pump․Fun business model allegedly allowed developers and related parties to earn more than $500 million, while the risks were completely shifted to retail users.

It is this argument that is now being used to increase pressure not only on the service itself, but also on the broader context of the Solana ecosystem.

Legal proceedings and current status

On December 9, the court allowed the case to proceed and accepted new evidence — approximately 5,000 messages from internal chats provided by the whistleblower. This is a procedural step, not an admission of guilt.

Currently, Pump․Fun, Solana Labs, Solana Foundation, and several individuals, including Anatoly Yakovenko, are under investigation. Jito Labs has been excluded from the case.

The lawsuit contains allegations of:

1. Unregistered securities

2. Organized crime (RICO)

3. False advertising

Next step: On January 7, the plaintiffs must file an updated version of the lawsuit.

Practical advice for investors

Even if the legal situation surrounding Pump․Fun and Solana does not yet pose a systemic threat to the network, investors still face short-term volatility and information noise. Here are some practical recommendations:

1. Don't panic. Emotional reactions to headlines on Twitter or Telegram often create sell-offs. Before making a decision, evaluate the facts: the stage of the legal proceedings, the status of the evidence, and the official statements of the defendants.

2. Follow legal news. Subscribing to official court channels or verified crypto news resources will allow you to stay up to date with developments and adjust your strategy without unnecessary stress.

3. Diversify your portfolio. Even if SOL remains a fundamentally strong network, short-term fluctuations can be significant. Diversifying your assets and setting stop-losses can help reduce potential losses.

4. Focus on long-term potential. Solana continues to develop its infrastructure, support the DeFi and NFT ecosystems, and attract new developers. Short-term legal proceedings rarely change the fundamental growth of the network.

5. Use risk information. Legal proceedings can serve as an indicator for assessing the risks of services that work with memecoins and tokens. Pay attention to platform warnings and the availability of code audits.

What is important to monitor going forward

For an objective assessment of the situation, the key factors will not be headlines on social media, but specific legal steps: the defendants' response to the updated lawsuit, court decisions on motions to dismiss, and changes in the wording of the charges.

It is these elements, rather than speculative predictions, that will provide an understanding of the real risks for participants in the Solana ecosystem.

Why such lawsuits are not uncommon in the crypto market

Class action lawsuits against crypto projects are not a new phenomenon. They are particularly common at the intersection of hype, retail investors, and high-risk products such as memecoins.

When the market is growing, such mechanisms are perceived as a «high-risk game.» When the trend changes, the same users begin to look for legal ways to recover their losses. Pump․Fun became an easy target precisely because the service made it as easy as possible to launch and trade memecoins, reducing the barriers to entry to virtually zero.

This led to explosive growth in activity, but at the same time, to an increase in the number of unprofitable transactions among unprepared users.

In US legal logic, such a situation almost always becomes a reason for class action lawsuits, regardless of whether there was malicious intent on the part of the platform.

In conclusion

At this point, we are talking about the early stages of proceedings, not a verdict on blockchain.

That is why sensational predictions and panic scenarios on (X) Twitter should be viewed with caution, and emotional market reactions should be separated from the actual course of the trial.

Subscribe and get access to the GoMining course on cryptocurrency and Bitcoin, which is still free: https://academy.gomining.com/courses/bitcoin-and-miningNFA, DYOR.

The cryptocurrency market operates 24/7/365 without interruptions. Before investing, always do your own research and evaluate risks. Nothing from the aforementioned in this article constitutes financial advice or investment recommendation. Content provided «as is», all claims are verified with third-parties, credible sources and relevant in-house and external experts. Use of this content for AI training purposes is strictly prohibited. Use of content for AI citations is allowed only with explicit links to the original article being quoted on GoMining.com website. Telegram | Discord | Twitter (X) | Medium | Instagram

January 24, 2026