Most people today are convinced that home mining is dead. High electricity prices, noisy rigs, rising network difficulty — all of this seems to leave mining exclusively to large industrial data centers. This conclusion is wrong.

Home mining hasn’t disappeared — it has simply turned into an engineering problem rather than a lottery.

In 2026, the question is straightforward: either you squeeze maximum efficiency out of every watt, or you don’t mine at all. With the right approach, your “noisy heater” really can become a quiet, controlled source of income — not a fairytale one, but a stable and rational one.

This article is not about “getting rich fast.” It’s about economics, physics, and common sense.

Lifehack #1 — the “Free Heater” Strategy: Stop Treating Heat as Waste

The biggest mistake beginners make is seeing mining heat as a problem. In reality, heat is a useful product — one you already pay for every winter.

Any miner, whether a GPU rig or a compact ASIC, converts nearly 100% of consumed electricity into heat. The only difference from a standard electric heater is that mining produces computational output at the same time.

If during winter you spend, for example, $100 per month on heating, and at the same time:

- your miner consumes $100 worth of electricity,

- earns $70–80 in coins,

- and fully replaces an electric heater,

then the real cost of your heat approaches zero — and in some cases becomes negative.

In Canada, Germany, and Scandinavia, such micro-scale bitcoin mining facilities have long been used in apartments and private houses. This works especially well with low-RPM fans or liquid cooling systems.

A recent example comes from Canada, where a pilot project was launched using Bitcoin mining heat to warm industrial greenhouses in Manitoba, allowing tomatoes to be grown year-round. The 3 MW liquid-cooled installation returns up to 90% of consumed energy as heat, heating water above 75 °C without additional heating.

Source: GoMining.com

The project is designed for two years and reduces effective electricity costs to around $0.035 per kWh while lowering fossil fuel consumption.

This is why the term bitcoin mining power is increasingly viewed not only as a computational resource, but as small-scale energy infrastructure.

Lifehack #2 — Undervolting for more Crypto Mining Profit: “Less Is More”

Source: GoMining.com

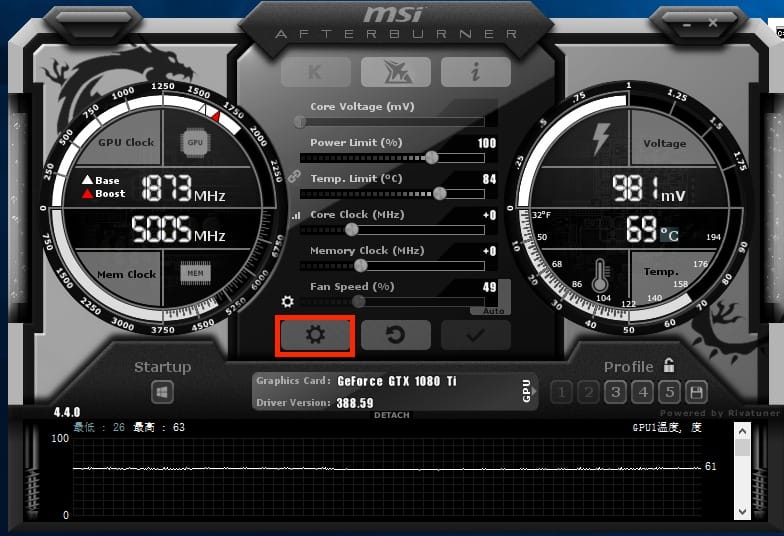

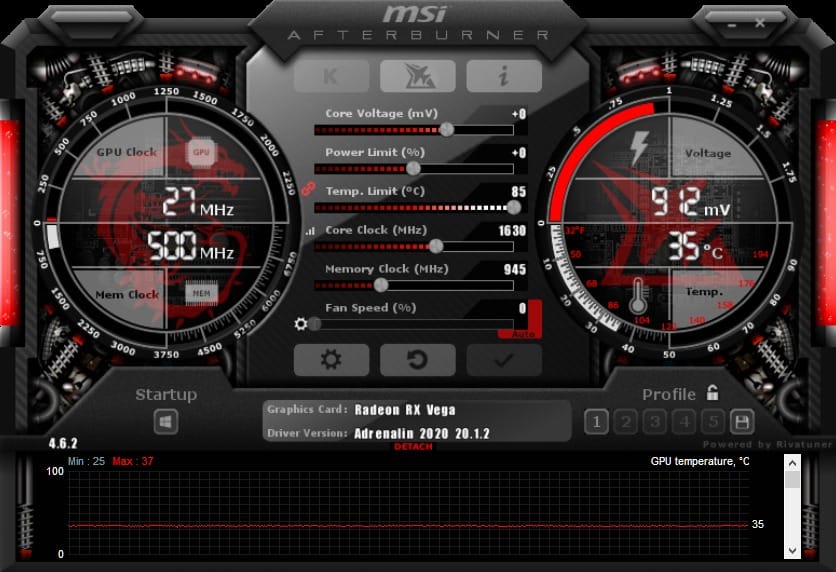

Factory settings on GPUs and ASIC miners are almost always excessive. Manufacturers prioritize stability under any conditions, not efficiency.

Undervolting is the art of reducing voltage without noticeable performance loss. In practice, this usually means:

- 3–7% less hashrate,

- 25–35% lower power consumption,

- significantly less heat and noise,

- longer hardware lifespan.

For GPUs, this is done using tools like MSI Afterburner or similar utilities. For ASICs, through custom firmware or low-power operating modes.

In the mining economy of 2026, maximum hashrate no longer wins. Hashrate per watt does. That’s why even older NVIDIA cards, when properly tuned, can remain profitable despite widespread claims that GPU mining is “dead.”

Lifehack #3 — The “Vampire” Schedule: Mine While Everyone Sleeps

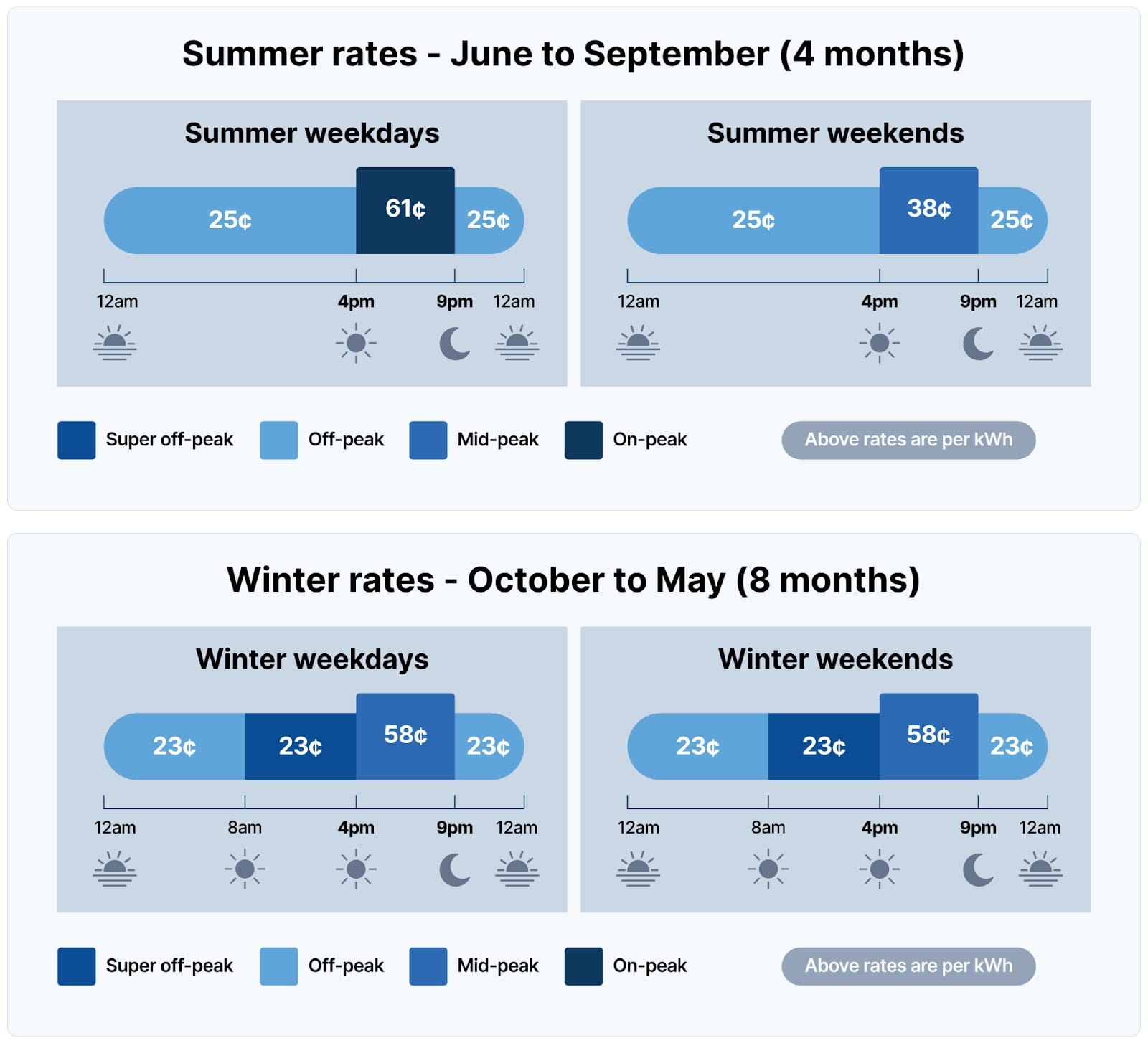

In many countries, electricity follows Time-of-Use pricing: power is 20–60% cheaper at night. Most home miners ignore this — and lose money every month. The solution is simple:

- a smart plug costing $10–15, or

- a basic scheduling script,

- mining, for example, from 12:00 AM to 6:00 AM.

Time-of-Use (TOU) electricity pricing model in the United States. Source: GoMining.com

Even if you mine only six hours per day, but at the lowest tariff, overall margins can be higher than running 24/7 at an average rate.

This approach pairs especially well with solar bitcoin mining: solar panels during the day, cheap grid power at night. In this setup, electricity effectively stops being the key cost factor.

Hybrid solar-powered data center, Texas. Source: GoMining.com

Lifehack #4 — Spec Mining: A Lottery Ticket with Math

Most people mine the same assets — Bitcoin, Litecoin, Ethereum Classic. The problem is that everything there is already calculated.

Spec mining is a bet on new or lesser-known networks with low difficulty. You mine coins that:

- are not yet traded on major exchanges,

- face weak competition,

- may “take off” within 6–18 months.

The risks are high — many projects won’t survive to listing. But one successful case can pay for the entire rig.

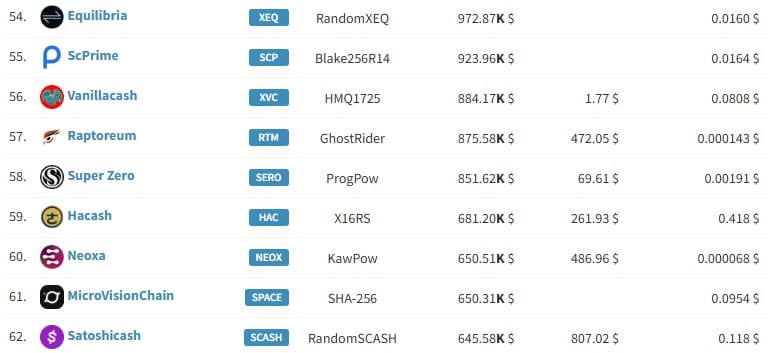

To find spec-mining opportunities, miners use services like MiningPoolStats, which track new low-difficulty networks before they reach major exchanges. Projects are then filtered through WhatToMine for energy efficiency and, at later stages, checked on CoinGecko or CoinMarketCap.

Source: Miningpoolstats.com

This is exactly how Ravencoin, Kaspa, and dozens of other assets were discovered and mined early. In essence, this is the most speculative — but also the most asymmetric — answer to the question of what cryptocurrency mining is.

Lifehack #5 — Kill the Noise, Not the Motivation

Most home miners quit not because of economics, but because of noise. 70–80 dB in an apartment is psychologically unbearable. There are solutions:

- DIY boxes with acoustic foam,

- insulated enclosures with directed airflow,

- immersion cooling in dielectric oil for the most adventurous.

Immersion mining tank: fanless cooling system. Source: GoMining.com

Yes, this requires time and experimentation. But silence is not a luxury — it’s a survival condition for home mining.

Why These Crypto Mining Lifehacks Still Work

Despite rising difficulty, mining still offers opportunities. According to CoinGlass, volatility in Proof-of-Work networks remains high. This means that even small miners periodically hit windows of elevated profitability, when rewards temporarily exceed long-term averages.

At the same time, DeFiLlama reports growing interest in DePIN projects, where computing power and energy become part of a new hybrid economy rather than “wasted hash.”

Nansen analysts also note an increase in wallets associated with small and home mining pools — especially in the segment of energy-efficient, low-power devices. This indicates that mining is increasingly adapting to household conditions rather than purely industrial farms.

As an alternative, virtual miners from GoMining can be considered — one of the easiest ways to enter mining with a low entry threshold.

Conclusion: How to Make Crypto Mining Work in 2026

Home mining is no longer “plug and forget.” It’s an engineering system where the following matter:

- heat,

- noise,

- tariffs,

- tuning,

- strategy.

If you adopt even one of these lifehacks — ideally starting with undervolting — you’ll already be ahead of 80% of home miners.

Follow GoMining Academy and get access to the crypto and Bitcoin course — it stays free while most of the market is still waiting for a “perfect entry.”

Telegram | Discord | Twitter (X) | Medium | Instagram

FAQ

Is home mining still worth it?Yes, if you calculate the full economics: heat reuse, tariffs, undervolting, and operating schedule. “Plug and forget” no longer works.

Is home mining legal?In most countries — yes. Restrictions usually relate to noise, grid load, or industrial-scale usage.

Can I mine Bitcoin at home?Directly — almost no. But through heat reuse, night tariffs, and compact ASICs, it can still work as part of a hybrid strategy.

Is GPU mining dead?No. It has shifted toward altcoins, spec mining, and AI-related workloads where energy efficiency matters.

What does undervolting actually give?3–7% less hashrate and up to 30% lower power consumption. Quieter, cooler, cheaper — the key to survival in 2026.

Does mining only at night work?Yes. With Time-of-Use tariffs, 5–6 night hours can be more profitable than 24/7 operation at an average rate.

What is spec mining and why use it?Mining new or lesser-known coins with low difficulty. High risk, but one success can pay for the entire rig.

How important is noise?Critical. Most quit because of 70–80 dB. Enclosures, airflow control, or immersion cooling are not optional — they’re necessary.

Can solar power make mining profitable?Yes. In a “day — solar, night — cheap grid” setup, electricity stops being the main cost constraint.

January 24, 2026