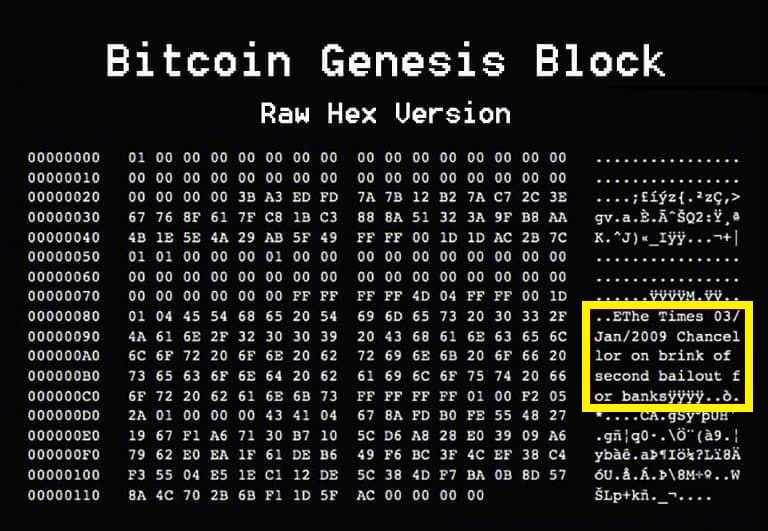

On January 3, 2009, while the global financial crisis had not yet become a dry paragraph in economics textbooks, the first block of a new digital system appeared on the network.Not a startup. Not a company. Not a product. Just a block of data — the Genesis Block.

Inside it was a message that today is quoted more often than many official economic reports: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

Source: Bitcoin Genesis Block.

This was not a technical comment and not an inside joke. It was a timestamp of an era.At the very moment when governments were once again rescuing banks at the expense of taxpayers, someone encoded a different idea into software: money can exist without a center, without an issuing committee, and without trust in any single institution.

This is where the story of Bitcoin mining begins — not as a way to make money, but as an engineering answer to a fundamental question: How can digital money exist if it cannot be forged or copied?

Today, mining is usually discussed through electricity bills, mining farms, ASICs, and hash rate. But if you strip away all the noise, one simple and uncomfortable question remains:

Why do we need to burn electricity to create digital money at all?

At first glance, this seems absurd. A file can be copied for free. A database can be updated in milliseconds. Why complicate things?

The answer lies not in economics — and not even primarily in cryptography.It lies in the very nature of digital information.

Why Digital Money Failed for Decades

Before Bitcoin, digital money had been attempted many times. There were projects, protocols, academic experiments, and enthusiast initiatives. All of them ran into the same wall — the double spend problem.

Any digital object can be copied. An MP3 file, a document, an image — none of them has a physical “original.” If I send a file, I still keep a copy. For money, this is fatal.

Historically, the only way to solve this problem was a central ledger. A bank, payment processor, or clearing house that says: “This transaction was first. That one was not.”

We trust the center — and the system works.

But if you remove the center, who decides which transaction is real?

Why You Can’t Just “Agree”: The Birth of Proof of Work

The intuitive solution seems simple: let network participants agree among themselves.But in an open system, where anyone can join, there is always an incentive to cheat.

If writing to the ledger costs nothing, an attacker can rewrite history as often as it benefits them. This is where the key idea emerges:

For a ledger entry to be honest, it must have a real cost.

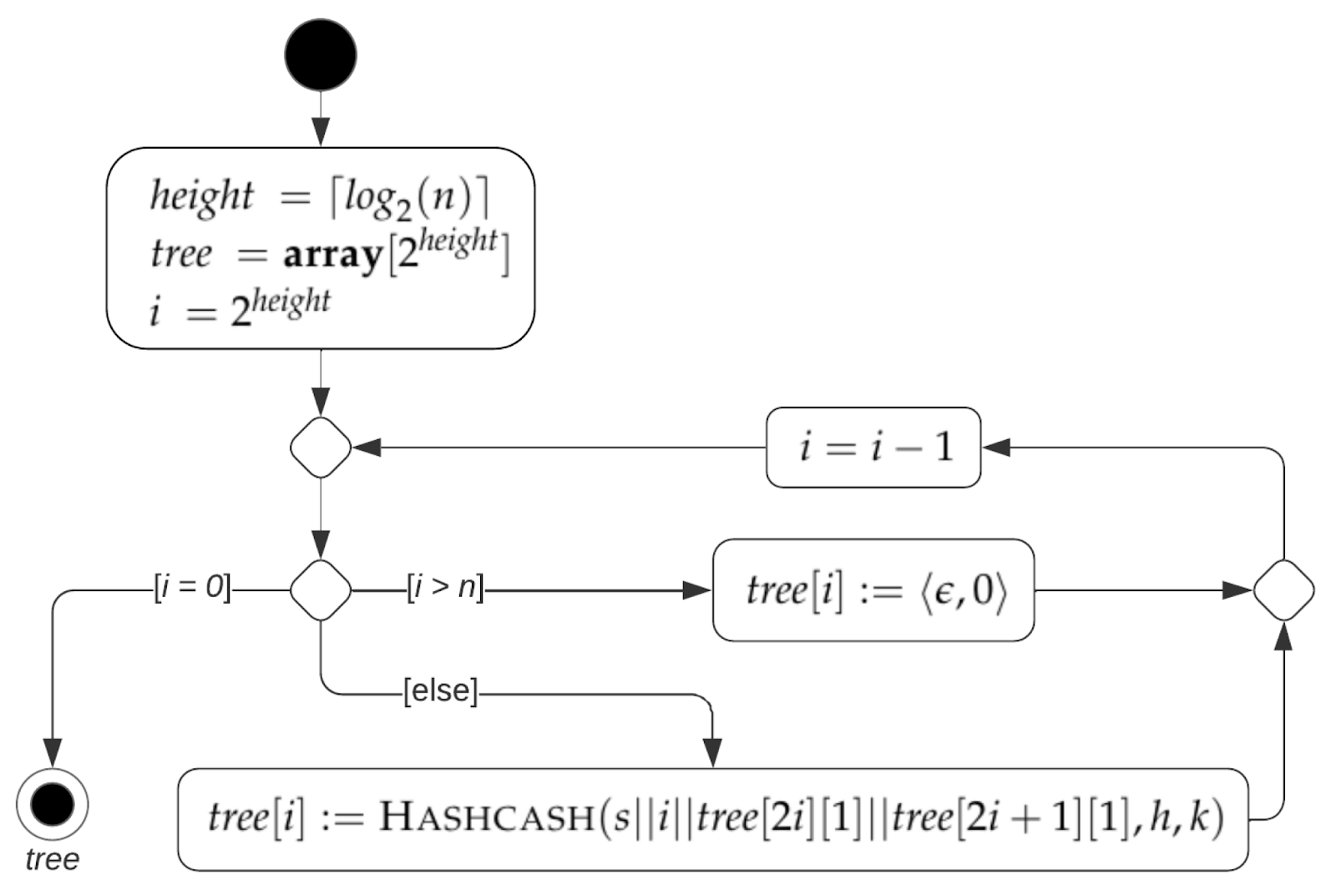

At this point, Satoshi Nakamoto adapted an idea that already existed.It was invented in the late 1990s by cryptographer Adam Back to fight email spam.The concept was called Hashcash.

Hashcash Tree

Before sending an email, a computer had to perform a small but computationally expensive task. For a normal user, it was barely noticeable. For a spammer sending millions of emails, it became prohibitively expensive.

Satoshi took the next step: he turned this computational entry fee into a consensus mechanism.

Mining as a Digital Lottery

Bitcoin mining is not extracting something from thin air, and it is not “printing money.”It is a lottery where every participant buys a ticket with electricity and hardware.

You are not proving that you are a good person.You are proving that you spent a real resource.

If you win, you earn the right to add a new block to the chain and lock in transaction history.If you lose, your computations simply become part of the global competition.

This model is brilliant for one simple reason: Cheating becomes more expensive than honest behavior.

2009: When Everything Started with a Laptop. The CPU Era and the First Participants

In 2009, mining looked almost naive.

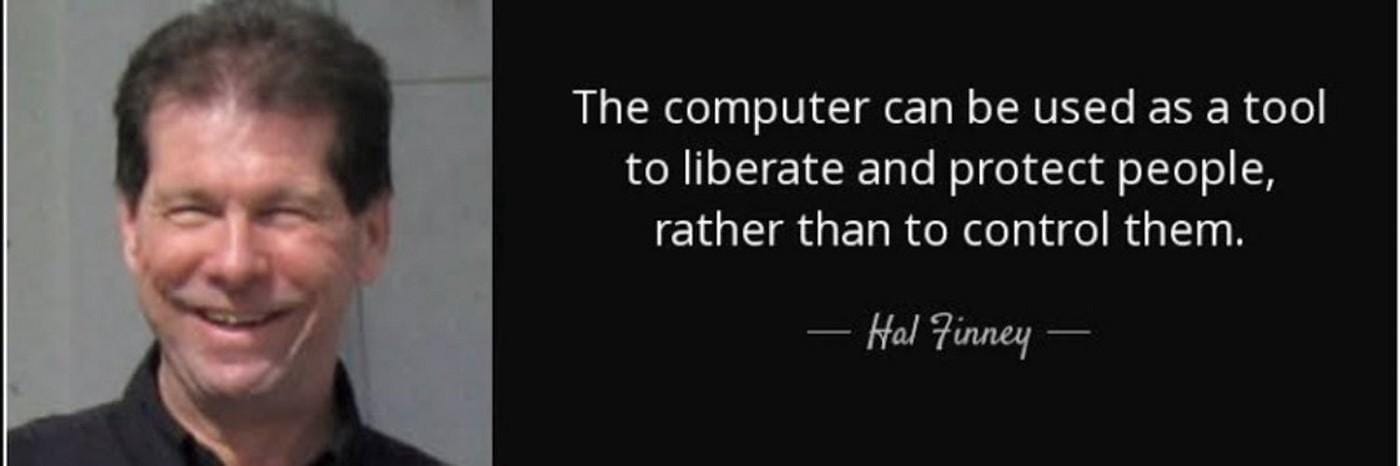

Satoshi Nakamoto and a handful of people from the cryptography community ran the software on ordinary personal computers. Among them was Hal Finney, one of the first people to receive a Bitcoin transaction.

No farms.No noise.No competition.

Source: GoMining.com

Blocks were found easily. The reward was 50 BTC, and in a single day you could mine an amount that today looks surreal. What mattered more was something else:

- no premine,

- no hidden allocation,

- no early investors.

It was arguably the fairest issuance model in the history of digital assets. The CPU era set Bitcoin’s core narrative: anyone can participate.

Yes, the economics changed later. Yes, this phase cannot be repeated. But it was precisely this open, zero-point start that created trust — not through promises, but through transparent rules.

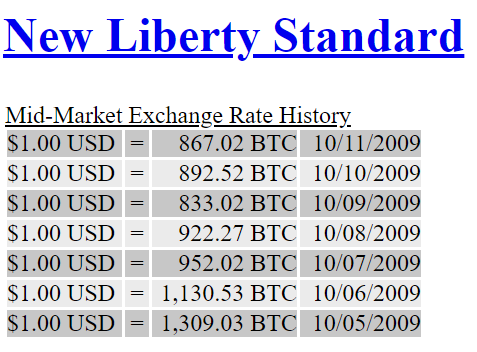

Notably, in 2009 the first online Bitcoin exchange, New Liberty Standard, appeared.It was an experimental service where BTC could be exchanged for US dollars — and it marked the birth of crypto trading.

Source: New Liberty Standard

By 2010, one thing became clear: if the system truly worked and carried real value, it could not remain a hobby.

Price growth, rising interest, and increasing competition inevitably led to optimization. This marked the beginning of the next chapter — the GPU revolution, the race for computing power, and the first signs of industrialization.

Proof of Work in Practice — and Why CPU Mining Was Doomed

In Bitcoin’s earliest months, Proof of Work looked almost abstract. It functioned. Blocks were found. Transactions were confirmed. But all of this happened within a small circle of people for whom the idea of decentralized money mattered more than potential profit.

Everything changed once Bitcoin acquired a market price. At first symbolic. Then meaningful. At that moment, it became obvious: if participation in the network offers an economic advantage, people will search for ways to do it more efficiently.

A CPU is a universal tool. It can do many things reasonably well, but nothing exceptionally.The SHA-256 algorithm underlying Bitcoin does not require complex logic — it benefits from massive parallel computation.

And here an insight emerged that was obvious to engineers, but not to most users: A graphics card is not a gaming device — it is a massively parallel processor.

One GPU could perform thousands of identical operations simultaneously. In mining terms, this meant an order-of-magnitude performance leap.

The GPU Breakthrough and the First Turning Point

In the spring of 2010, programmer Laszlo Hanyecz published code that enabled Bitcoin mining on GPUs. History remembers him primarily as the man who paid 10 000 BTC for two pizzas, but his technical contribution was far more important.

Laszlo Hanyecz, 10000 BTC Pizza Purchase.

GPU mining instantly broke the existing balance. Those who continued using CPUs began to lose. Network difficulty increased. Blocks no longer “fell from the sky.” Competition became real.

This was the moment when Bitcoin stopped being an equal game in practice. Formally, anyone could still participate.In reality, winners were those who understood hardware, optimization, and economics.

This was not a flaw in the system — it was its logical consequence. Proof of Work does not promise equality of outcomes. It guarantees equality of rules.

If you find a way to perform the work faster honestly, the network accepts it.

Thus began the efficiency arms race that would eventually lead to full-scale industrialization.

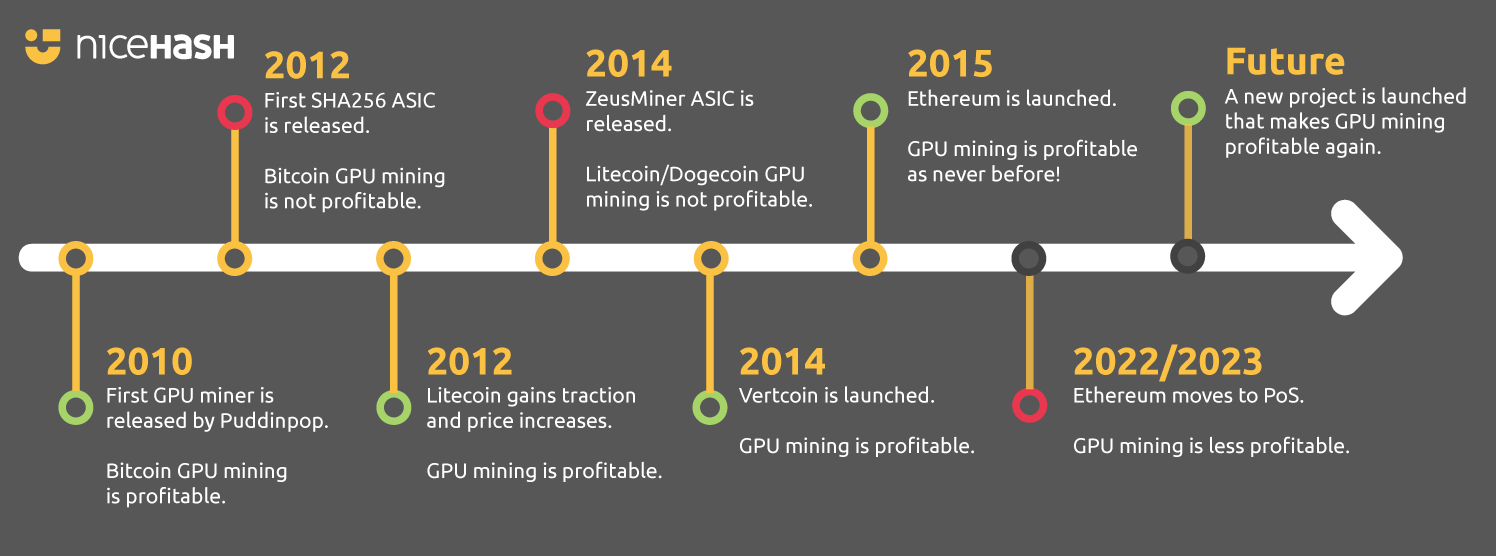

Source: Nicehash.com

One of the most underestimated components of Bitcoin is its automatic difficulty adjustment.

Every 2016 blocks, the network measures how long it took to produce them and adjusts difficulty so that the average block time remains close to 10 minutes.

The GPU revolution became the first serious stress test of this mechanism.

Hash rate increased. Difficulty followed. And the system continued to operate — without votes, upgrades, or manual intervention. This was the moment it became clear: Bitcoin scales not through trust, but through mathematics.

When Mining Started Counting Money

As difficulty increased, a new question emerged: profitability. What had once been a nearly free background process now required investment:

- graphics cards,

- cooling,

- electricity.

The first profitability calculations appeared. So did the first mining pools.And for the first time, people openly discussed mining as a business with risks, not just an experiment.

This is an important point: Economics did not destroy Bitcoin’s idea — it stress-tested it.

If the network had failed under optimization pressure and human greed, it would have collapsed right there.

GPU mining is sometimes portrayed as a “distortion of the original vision.”That is a mistake.

Satoshi did not design Bitcoin for permanent equality. He designed it to be robust under rational behavior.

If participants act in their own interest and the system remains secure, the model works. The GPU era proved exactly that.

By 2011, it became obvious: the next optimization would be even more radical. If GPUs are more efficient than CPUs, what stops us from building a device that performs only SHA-256 calculations — and nothing else?

The answer was inevitable: first FPGAs, and then ASICs.

And it was precisely these technologies that would turn mining into a full-scale industry.

The Industrial Revolution: How Mining Became a Global Business

By 2011, GPU mining was no longer exotic. It worked, generated income, and steadily pushed out anyone who failed to keep up with rising difficulty.

At the same time, something else became clear: a GPU was still a compromise. Powerful, but universal. And universality always implies inefficiency.

Within the logic of Proof of Work, this meant only one thing: The next step was hardware built for a single, specific task.

The first move toward full specialization came with FPGAs — programmable logic arrays.They were significantly more efficient than GPUs in terms of hash rate per watt, but remained expensive and complex to configure.

FPGAs never became a mass solution, but they played a crucial role:they demonstrated that specialization delivers exponential gains — and therefore ASICs were inevitable.

ASIC stands for Application-Specific Integrated Circuit: a chip designed to perform one task only. In Bitcoin’s case — SHA-256 hashing.

Source: GoMining.com

From an engineering perspective, this is close to perfection: minimum excess transistors, maximum efficiency.

From an ecosystem perspective, it was a shock.

Source: GoMining.com

With the arrival of ASICs, it became obvious: mining was no longer a hobby. A regular user with a GPU simply could not compete with a device that was hundreds of times more efficient. A new phase began:

- capital investments,

- logistics,

- electricity contracts,

- cooling,

- maintenance.

This is how the concept of the mining farm was born — a data center where computation itself became a commodity. At the same time, ASICs introduced a new point of centralization: hardware manufacturing. Companies like Bitmain set the pace for the entire industry.

This raised concerns: if a handful of manufacturers control supply, does that undermine decentralization?

The answer turned out to be more nuanced than it appears.

The Paradox of Centralization and Real Security

At first glance, the situation looks alarming:

- large mining farms,

- mining pools,

- industrial scale,

- geographic concentration.

But Bitcoin never promised decentralization in the sense of “everyone is equal.”It promised no point of control over the rules. Even the largest miner cannot:

- change the issuance schedule,

- rewrite old blocks without astronomical cost,

- impose new rules on the network alone.

Economic centralization is not the same as protocol centralization. This distinction is fundamental.

Difficulty Adjustment: The Quiet Backbone of Bitcoin

The more miners and hash power enter the network, the higher the difficulty.When miners leave, difficulty drops. This mechanism has been operating for more than 15 years without interruption or manual control. It is what makes Bitcoin resilient to:

- farm shutdowns,

- regulatory bans,

- equipment migrations,

- price crashes or spikes.

The 2021 mining ban in China became the clearest demonstration.

Bitcoin Mining Difficulty History Chart, charts.bitbo.io

Hash rate dropped sharply. Difficulty adjusted downward. And the network continued to operate — without forks or emergency measures. Bitcoin did not need coordination. It relied on math.

Mining Economics: Where the Romance Ends

Once mining fully industrialized, it became a classic infrastructure business with clear metrics:

- CAPEX for hardware,

- OPEX for electricity and maintenance,

- ROI dependent on BTC price and network difficulty.

There is no guaranteed return here. Only a cycle:

halving → margin pressure → consolidation → hardware renewal

This is why mining does not die — it periodically cleans itself.

There is a popular myth that ASICs “destroyed the original vision.”In reality, they did exactly what a robust system is supposed to do: They pushed out inefficient models.

Proof of Work is not about fairness. It is about verifiable cost. As long as mining remains economically competitive and open, network security only strengthens.

Why Mining Still Exists — and Why It Is Not Going Away

At first glance, Bitcoin should have abandoned mining long ago.It is expensive, energy-intensive, and poorly aligned with typical digital product logic.

But this “flaw” is precisely its main advantage.

Mining is not a technical relic of Bitcoin’s early days.It is a deliberately chosen security model, where the past is protected by real-world costs — not promises or social consensus.

To alter a past transaction in Bitcoin, persuasion is not enough.Access to a server is not enough.

You must reproduce all the computation that went into building the chain.

This creates a critical asymmetry:

The deeper a transaction is in the past, the more expensive it becomes to change.

That is why Bitcoin is not just a payment system, but an immutable ledger, resilient even to coordinated attacks by large actors.

Why a “51% Attack” Is Not a Textbook Scenario

In theory, controlling the majority of hash power allows an attacker to rewrite recent blocks. In practice, this implies:

- enormous capital expenditure,

- immediate market reaction,

- devaluation of both equipment and BTC holdings.

Economic incentives work against the attack. This is not protection based on morality.It is protection based on losses.

Source: GoMining.com

Mining and Energy: A Misunderstood Relationship

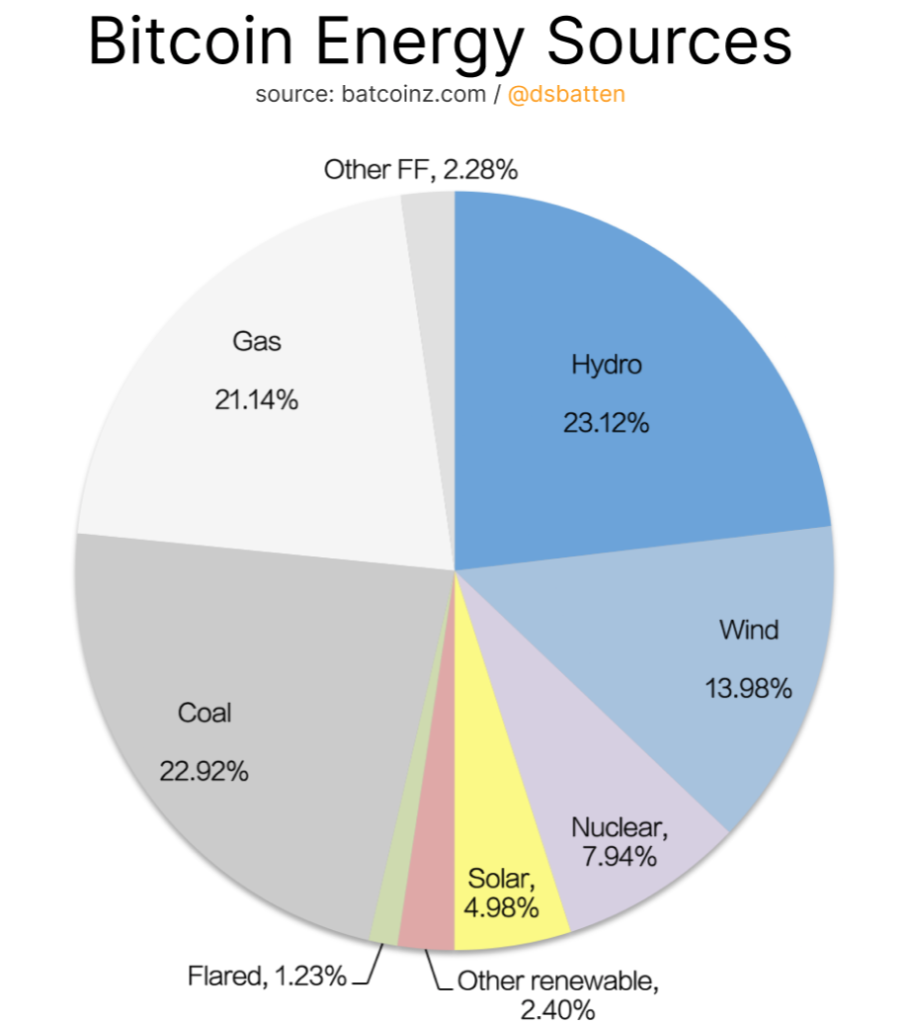

Mining does not “consume electricity for the sake of consumption.” It monetizes surplus and hard-to-transport energy. That is why mining operations appear:

- near hydroelectric plants,

- in regions with excess wind or solar power,

- next to stranded or flared gas sources.

Bitcoin became the world’s first buyer of last-resort energy — willing to purchase electricity where it would otherwise be wasted.

Source: GoMining.com

According to analytical platforms and research centers, the share of renewable and low-carbon energy in Bitcoin mining continues to grow. Not because of “green ideology,” but because of economics: renewable energy is cheaper and more predictable.

This is where Bitcoin unexpectedly intersects with energy transition, infrastructure, and DePIN, where computation and energy become part of a single economic model.

Halving: A Built-In Stress Test

Every four years, the block reward is cut in half.This is not a marketing event, but a hard economic filter.

Halving:

- reduces miner revenue,

- forces inefficient equipment offline,

- accelerates technological upgrades.

The network keeps running. Difficulty adapts. Weak players exit. Strong ones remain.

Painful — but this is how long-term resilience is maintained.

Why ETFs Strengthen Mining Instead of Killing It

The emergence of spot Bitcoin ETFs is often seen as the “final stage” of the asset. In practice, they do the opposite: they increase the importance of the base security layer.

The more institutional capital depends on Bitcoin, the higher the demand for immutability.

And here, Proof of Work remains the only model that scales without trust in governing bodies.

ETFs buy Bitcoin. Mining secures it. These are different layers of the same system.

Proof of Stake — and Why Bitcoin Chose a Different Path

Proof of Stake offers a different philosophy: security through capital. It works in systems where rule changes, social consensus, and active protocol governance are acceptable.

Bitcoin chose the opposite path. It is minimalist, conservative, and extremely cautious with change. In this architecture, Proof of Work remains the only mechanism that does not require trust in participants with large balances.

This is not “better” or “worse.” It is a different risk choice.

Where Mining Is Heading in 2026

In the coming years, mining will look less like a “crypto industry” and more like:

- energy infrastructure,

- a computation market,

- a financial backbone for digital gold.

We will see:

- growth in long-term energy contracts,

- deeper integration with data centers,

- further ASIC optimization,

- an expanding role of mining as a grid stabilizer.

Most importantly, no technological alternative to Proof of Work for Bitcoin is visible on the horizon.

Conclusion: An Uncomfortable but Unbreakable System

Bitcoin mining has evolved from a laptop on a kitchen table to a global energy market.

It replaced romance with pragmatism — but preserved the core principle: independence from trust.

It is the most secure computing network in human history not because it is fast or convenient, but because its past costs real money. And while the world continues to wait for a “perfect entry,” Bitcoin keeps doing what it has done from the very beginning: finding a new block every ten minutes.

Follow GoMining Academy and get access to the crypto and Bitcoin course — it stays free while most of the market is still waiting for a “perfect entry”.

Telegram | Discord | Twitter (X) | Medium | Instagram

FAQ

Who mined the first Bitcoin?Satoshi Nakamoto mined the Genesis Block on January 3, 2009.

What was the first mining hardware?A standard CPU running on a personal computer.

Why did Satoshi choose Proof of Work?Because it was the only known way to solve the double-spend problem without relying on a central authority.

Is GPU mining still viable for Bitcoin today?No. Since 2013, the Bitcoin network has been dominated entirely by ASIC miners.

Why doesn’t Bitcoin switch to Proof of Stake?Because Bitcoin’s security model does not allow governance through capital ownership or social coordination.

Can Bitcoin mining be completely banned?Locally — yes. Globally — no. Mining migrates to regions with available energy and favorable economics.

Does Bitcoin’s security depend on its price?Indirectly. Price influences hash rate, but network difficulty automatically adjusts.

Will Bitcoin mining become “green”?It already is moving toward the cheapest energy sources, which increasingly turn out to be renewable.

Can old Bitcoin transactions be rewritten?Practically no. The deeper a transaction is buried in the chain, the more expensive and complex it becomes to alter due to accumulated Proof of Work.

What happens to mining after all BTC is issued?Miners will earn revenue from transaction fees, and network security will continue to be provided by computational work.

Why does mining difficulty keep increasing over time?Because more efficient hardware enters the network, while the protocol automatically maintains an average block time of around 10 minutes.

January 24, 2026