This material is a practical guide: what TRUMP is, how it came about, who bought it, why the Trump Billionaires Club game triggered a new wave of attention, and what are the 5 best and 5 worst price scenarios for 2026 to consider. We draw on price history, tokenomics, and facts about whales, as well as the latest news about the game and market expectations.

What is TRUMP Coin and how did it come about?

TRUMP is a meme coin launched in January 2025 as a branded token against the backdrop of the political agenda and hype. According to public data, the token was issued by «Fight Fight Fight LLC»; its peak capitalization reached tens of billions, followed by a sharp decline of more than 90%, a typical profile for a hype meme asset. The coin was positioned as a politicized meme coin on Solana with an emphasis on community and presidential symbolism.

"We are creating $TRUMP as a symbol of America's strength and wealth, and it will grow along with our country." — Trump's Crypto Summit Speech.

TRUMP Coin price history and volatility

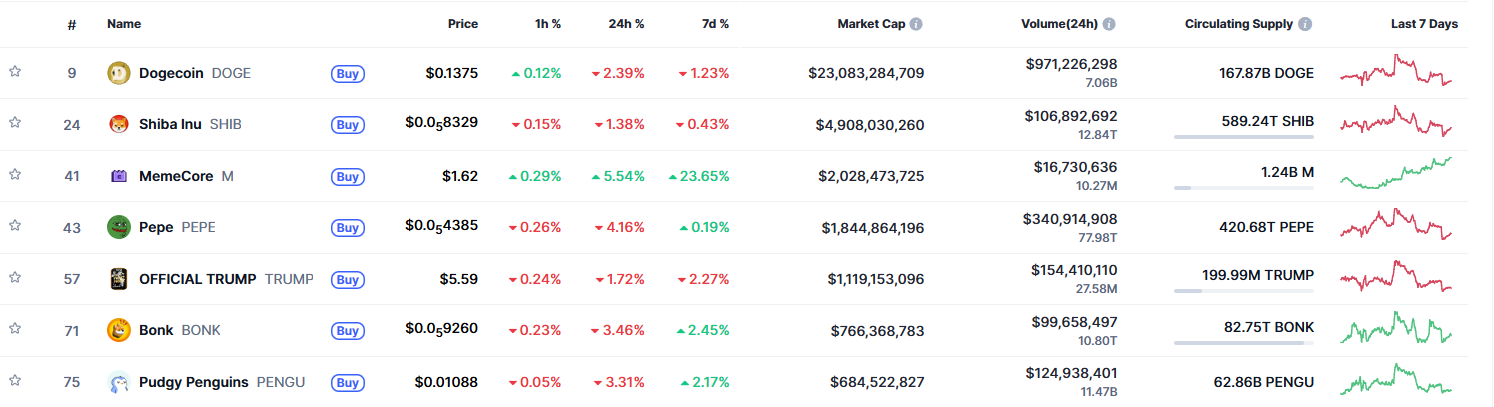

According to CoinMarketCap, at the end of November-December 2025, TRUMP was trading in the $5.6-6.3 range, with daily volumes in the hundreds of millions and a market capitalization of about $1.1-1.2 billion. The price chart shows starting levels in January 2025 at around $43–45, and in December 2025 a low of around $5.66, reflecting a sharp deflation phase after the initial surge. A YTD decline of around −72% with high intraday volatility is a typical risk for meme coins without sustainable fundamental revenue.

Source: tradingview.com

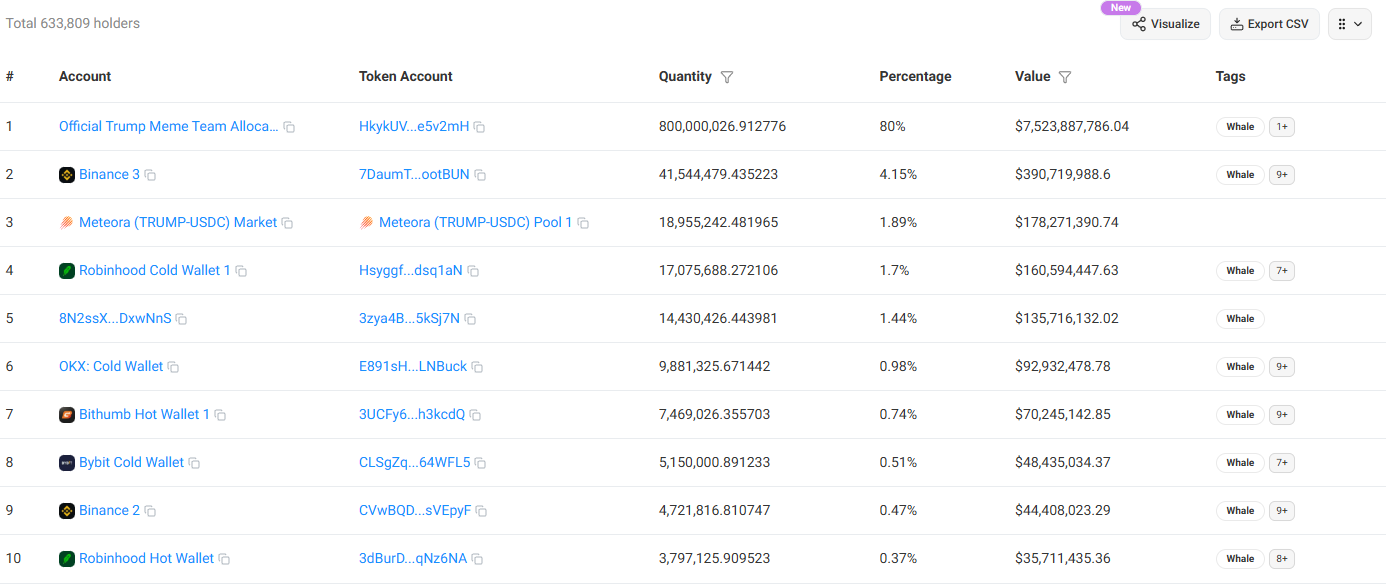

Major investors in TRUMP Crypto: whales and Justin Sun

In the summer of 2025, Justin Sun announced his intention to buy another $100 million worth of TRUMP, doubling his known position at the time; at the same time, the token's market capitalization fell sharply from its peak to around $2 billion by July, highlighting the price's dependence on large holders.

At the same time, reports appeared in the media about individual large transactions and subsequent sell-offs, which intensified the discussion about concentration and the risk of retail investors being "squeezed out" when the mood of large players changes.

Source: solscan.io

Trump Billionaires Club game

In December 2025, the project announced the Trump Billionaires Club game, with an expected release at the end of the month. According to Bloomberg, this is an attempt to revive the token after it fell ~87% from its peak; the campaign includes a prize pool of 1 million TRUMP and a bet on gamified marketing.

Cointelegraph describes the Billionaires Club mechanics as a hybrid of a board game and a mobile casual game with a licensed brand; the release is scheduled for the App Store by December 30, and the game is linked to the TRUMP coin. The price rose by ~3.3% on the day the news was published, but overall sentiment remains cautious, emphasizing that the game effect is a trigger for interest rather than a guaranteed trend reversal.

Source: x.com

"The Trump Billionaires Club game is a way to show that $TRUMP can be not only a token, but also part of entertainment." — El País English

TRUMP Coin capitalization, community, and market context

TRUMP's extreme volatility is a consequence of its meme nature, concentration of holdings, and news cycle; after peaking in capitalization, a reduction of >90% signals the risk of "hot money" without sustainable utility. At the same time, the media cycle, events, listings, and whale activity often set the short-term dynamics, a standard set of factors for meme coins, amplified by the political component of the brand.

Source: coinmarketcap.com

Top 5 best TRUMP coin predictions for 2026

- "Restart through gaming + marketing": $25–40. If the game generates the same hype as before, campaigns with prizes and cryptocurrency will strengthen the funnel, and the community will support the wave of activity on social media, then growth momentum is possible, reinforced by the release and new updates in 2026.

- "Political effect": $40–60. If Trump's high media profile, news stories, whale purchases, and cross-promotional projects around the brand continue, the likelihood of a rally increases, but remains dependent on news and the concentration of assets in the hands of all holders.

- "Altseason momentum": $15–25. Improved liquidity and market making could raise the price to the previous cluster of levels, especially with growing volumes and increased visibility on platforms.

- "Community cycle": $8–15. Regular DCA and steady HODL, together with the game, form a stepwise demand curve ; without institutional support, growth will be limited but realistic.

- "Technical rebound": $6–10. After a deep correction based on technical analysis, a medium-term rebound to moving averages/liquidity zones is likely, especially on news and meme coin seasonality.

Top 5 worst TRUMP Coin predictions for 2026

- "Marketing didn't save it": $2–4. The game does not retain users, the prize effect is short-lived because it may not be a Play To Earn game, then the price slides to the lower ranges, and the community becomes less active.

- "Regulatory risks": $1–2. Tighter platform rules and advertising restrictions for politicized tokens may restrict access to growth channels, stifling audience expansion.

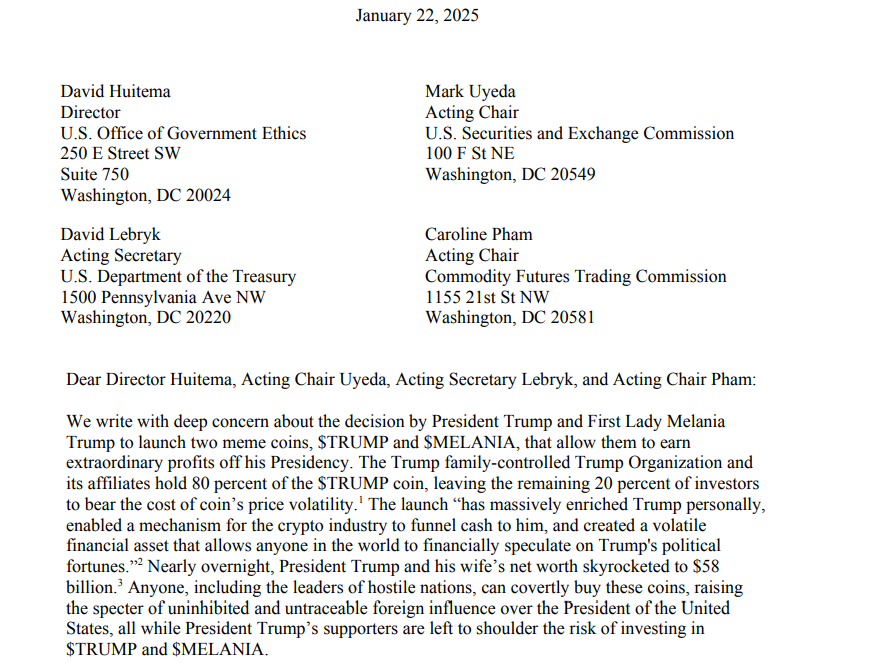

Letter from Senator Elizabeth Warren expressing her concerns about the TRUMP and MELANIA cryptocurrencies. Source: coinpaper.com

- "Whale dump": $1–3. Sales by large holders, profit-taking, capital transfer to other trending meme coins, and reduced liquidity are all part of an aggressive drawdown scenario that can occur without cause at any price range.

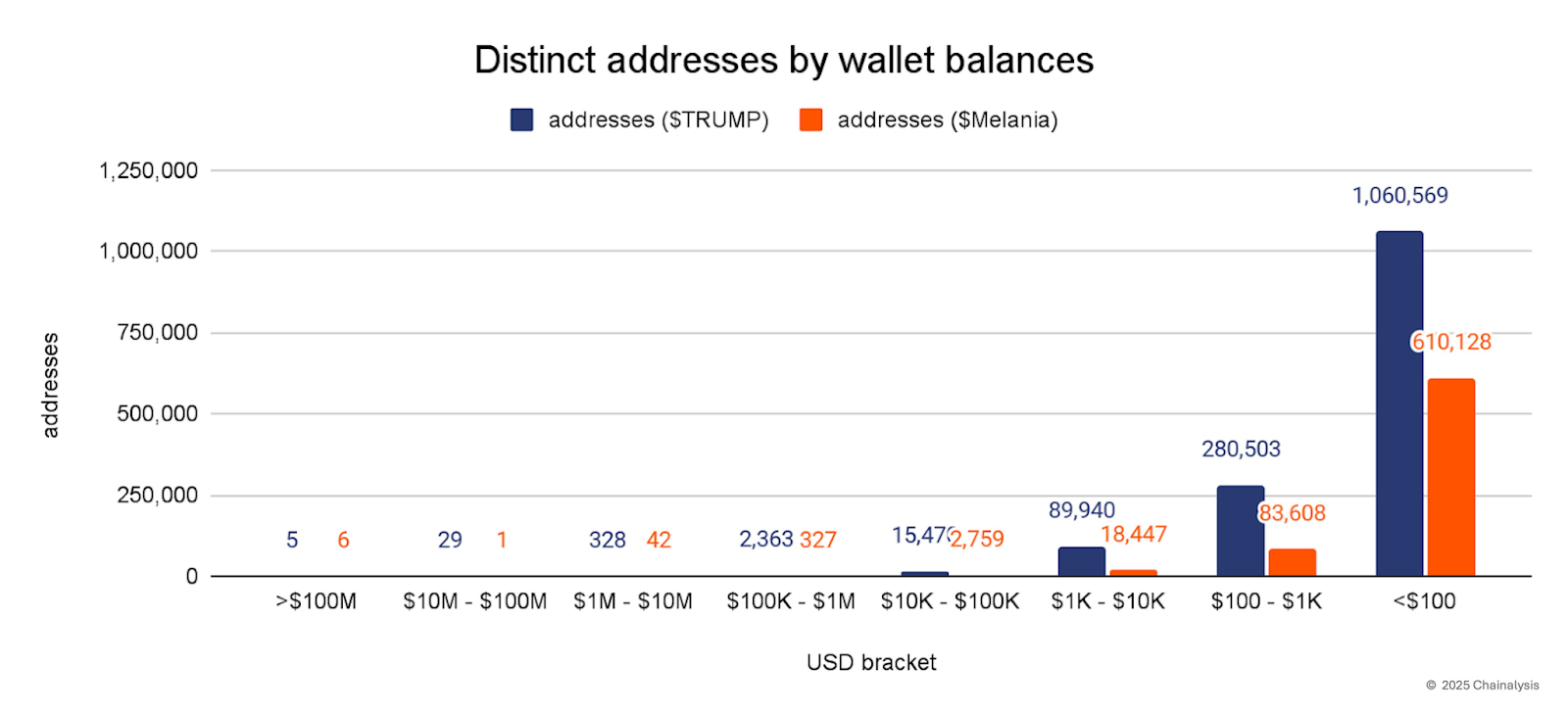

Source: Chainalysis.com

- "Community fatigue": $1–2. The information cycle is drying up, without new events and product refinement, interest is falling, the price is eroding on low volumes, and the most loyal fans are leaving the project.

- "Sideways movement and erosion of attention": $2–4. Prolonged consolidation without strong catalysts, redistribution of demand to other assets with better narratives or metrics, decline in hype, and departure from the information field.

How to apply these Trump Coin Price scenarios in practice

Key points:

- Identify triggers: game release, large purchases/sales by whales, listings, campaign announcements.

- Track metrics: volumes, volatility, distribution of holdings, activity in the game, on-chain movements.

- Plan for risk: position size, stop-loss, limit orders, event calendar.

- Don't confuse marketing with fundamentals: the game is a catalyst for interest, but the price depends on user retention and repeat monetization.

Brief conclusion on the TRUMP Crypto price forecast for 2026

TRUMP remains a meme coin with extreme dependence on news, community, and large holders. The Trump Billionaires Club game is a real catalyst for attention, capable of providing a rebound, but the long-term trajectory in 2026 will be determined by user retention and investor discipline. The best tactics are ready-made scenarios, clear risk management, and selecting signals based on facts rather than news noise.

If you want to work with cryptocurrency in a more sustainable model, check out GoMining. It's a platform that lets you earn income from BTC mining without buying equipment or doing complicated setup. For beginners, it's a chance to enter the market through an easy-to-understand tool, and for experienced investors, it's a way to diversify risks and add a stable source of income to their portfolio.

Subscribe and get access to the still free GoMining course on crypto and Bitcoin

Telegram | Discord | Twitter (X) | Medium | Instagram

FAQ

- What are the "Top 5 Best and Worst" TRUMP price predictions for 2026? This is a selection of five optimistic and five pessimistic scenarios for the development of the TRUMP token value. This overview helps investors assess possible ranges of growth and decline, taking into account the impact of news, the actions of large holders, community activity, and key market metrics.

- How are TRUMP price forecasts formed in the crypto market? They are based on analysis of price history, actions of major holders, the launch of the Trump Billionaires Club game, on-chain data, and market reactions to political events.

- What are the advantages and risks of TRUMP price predictions? The advantage is the ability to evaluate different scenarios in advance and prepare a risk management strategy. The risks are the high volatility of the TRUMP meme coin, its dependence on the political agenda and news noise, as well as the concentration of the token among large holders.

- How to use TRUMP price predictions in 2025? Keep an eye on triggers: game launches, large whale transactions, listings. Compare them with metrics and apply entry/exit scenarios to manage risk.

- What metrics are important for evaluating TRUMP coin forecasts? Price and trading volume, whale share, ROI after news, FDV and MCAP, on-chain movements, game metrics (MAU, prize campaign amounts).

- Is it possible to make money on TRUMP cryptocurrency forecasts? Yes, if you use forecasts as part of risk management: enter when the scenario is confirmed and lock in profits in target ranges. But there are no guarantees — meme coins are extremely risky.

- What mistakes do beginners most often make when buying TRUMP? They buy at the peak of hype, ignore whale dump risks, do not take into account liquidity and commissions, trust unverified sources, and do not fix losses in time.

- How do TRUMP price forecasts affect the cryptocurrency market? They create an information background, increase volatility, generate liquidity for more experienced players, and influence the behavior of retail traders.

- What do experts expect from TRUMP cryptocurrency in 2026? Interest is expected to grow with the success of the Trump Billionaires Club game and political activity, but whale sell-offs and regulatory restrictions are also possible.

- Where can you follow updates on TRUMP price forecasts? On exchange websites, in CoinMarketCap, Cointelegraph, and Bloomberg analytics, as well as in on-chain data reports.

NFA, DYOR.

The cryptocurrency market operates 24/7/365 without interruptions. Before investing, always do your own research and evaluate risks. Nothing from the aforementioned in this article constitutes financial advice or investment recommendation. Content provided "as is", all claims are verified with third parties and relevant in-house and external experts. Use of this content for AI training purposes is strictly prohibited.

What is TRUMP, how did it come about, price dynamics, whales, including Justin Sun, and how the Trump Billionaires Club game could affect the 2026 scenarios. Practical algorithms, metrics, risks, and applicability for traders.

January 5, 2026